Roi roa roe formula

The first formula is most commonly in use for the. Retrun on Equity Net Income Shareholders Equity Retrun on Equity.

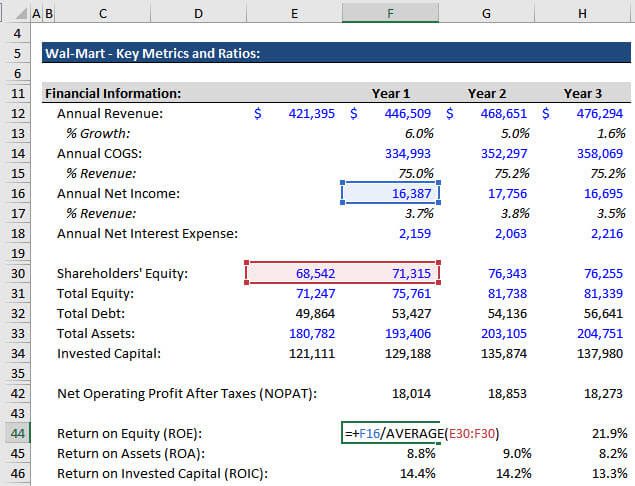

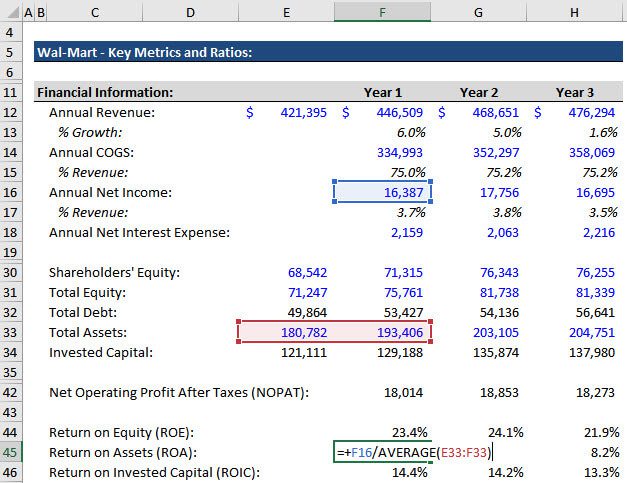

Roic Vs Roe And Roe Vs Roa Key Financial Metrics And Ratios

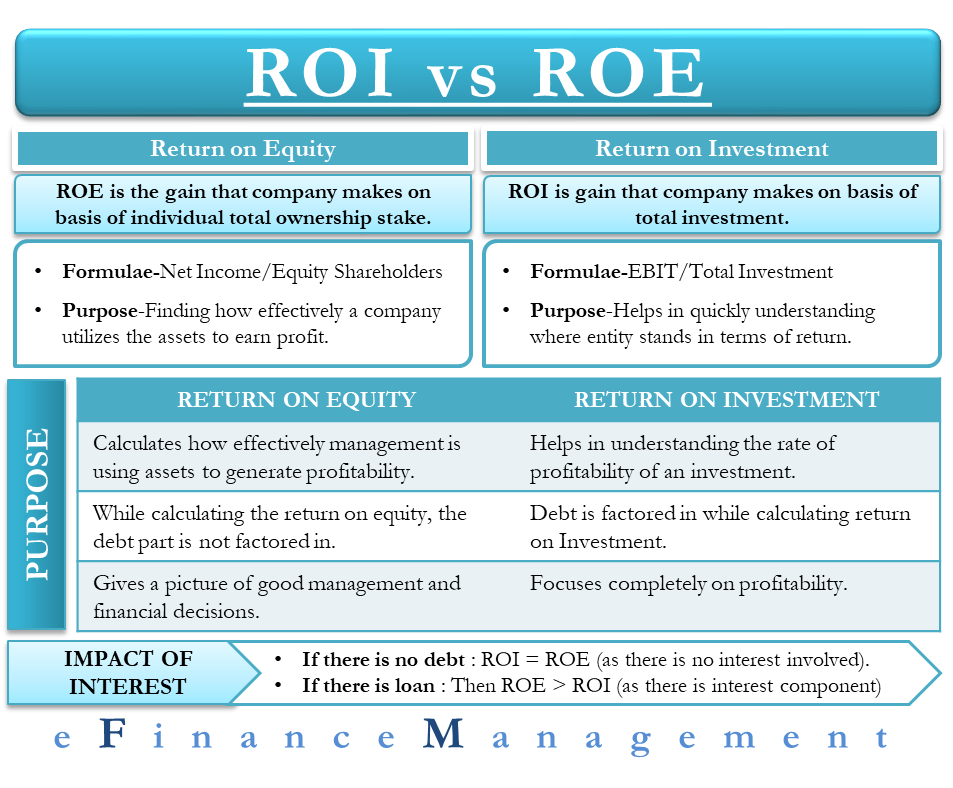

ROI - Return of investments measures the gain or loss generated on an investment relative to the amount of money invested.

. P Market price per share a Constant ROA Return on. Return on Equity ROE Return on equity ROE is the net income divided by shareholder equity. The formula for ROA is as follows.

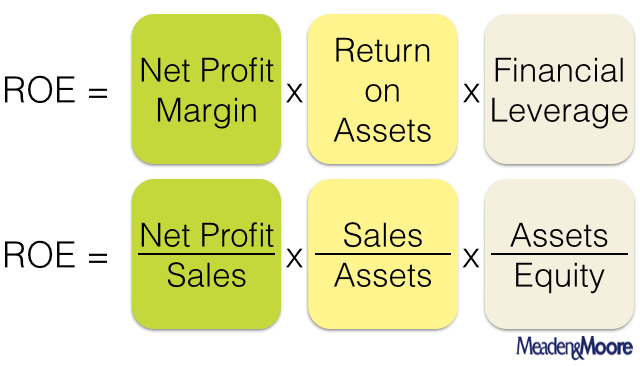

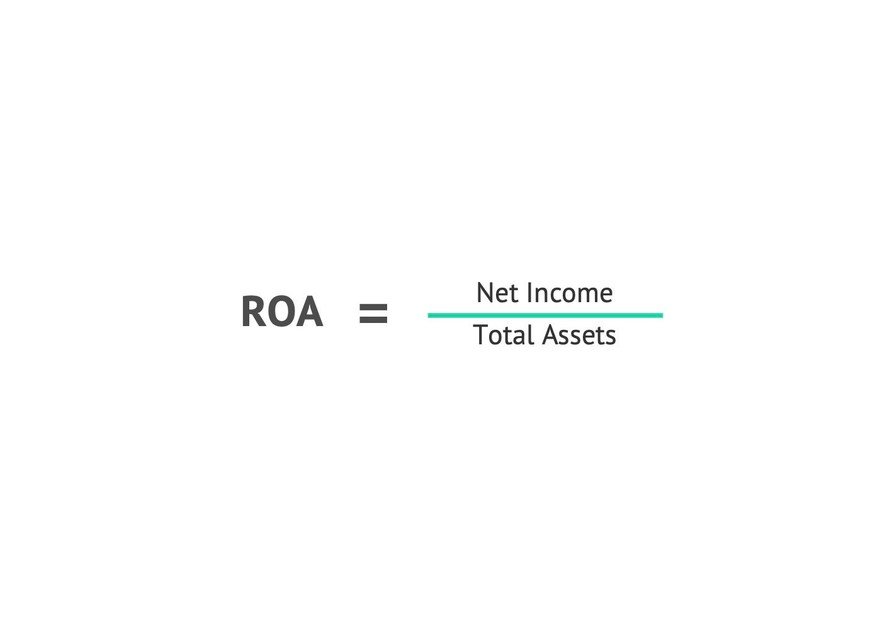

ROA Net Income Total. Return on Equity Profit Margin Total Asset Turnover Leverage Factor. Return on assets formula.

Why do we need them and what are the similarities an. ROE Net Earnings Shareholders Equity x 100 Heres how that plays out. ROE 60 x 76 x 175 ROE 798 Using the DuPont identity Becs Umbrellas calculates a ROE of 798 based on the three ratios included in the formula.

ROE can be calculated by multiplying ROA by the equity multiplier. The calculation can be. Net income refers to a companys total profits after deducting the.

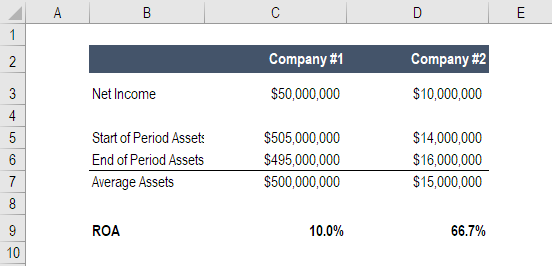

ROA net income divided by total assets. The return on assets formula is a simple one. P a b1 ROA it b2 ROE it b3 ROI it e it 1 P a b1 ROA it e it 2 P a b1 ROE it e it 3 P a b1 ROI it e it 4 Where.

Return on Assets Formula Calculating return on assets is simple. The formula for calculating the ROI is Net income Cost of investment Or Investment Gain Investment Base. ROI Net Income Cost of Investment or ROI Investment Gain Investment Base The first version of the ROI formula net income divided by the cost of an investment is.

ROA net income average assets Return on investment can be calculated by subtracting the cost of an investment from the gain received. Although there are multiple formulas return on assets ROA is usually calculated by dividing a companys net income by the average total assets. This companys Return of equity can be calculated by division of net income and average shareholders equity.

During that time the average. Return On Invested Capital versus Return On Equity versus Return On Assets versus Return On Investment. Return on Assets ROA Net Income Average Assets.

Lets say that company JKL had net earnings of 35500000 for a year. ROI Net Profit Cost of. The Calculations for ROE ROA and ROIC.

Simply divide a companys net income by its total assets then multiply it by 100. Or Dupont ROE Net Income Revenues Revenues Total Assets Total Assets Shareholders Equity. Return on Equity ROE Net Income Average Shareholders Equity.

Roic Vs Roe And Roe Vs Roa Key Financial Metrics And Ratios

Return On Assets Roa And Return On Equity Roe Fundamental Analysis Youtube

How To Calculate Return On Equity Roe With The Dupont Formula Meaden Moore

What Is Roa And How To Calculate It

Beginners Guide To Returns Roe Roa Roi R Doctorstock

Return On Equity Roe Definition Formula Seeking Alpha

Roa Return On Assets Accounting Kpi Billwerk Wiki

Return On Equity Roe Formula Examples And Guide To Roe

Return On Equity Roe Formula And Calculator Excel Template

How To Calculate Return On Assets Roa

Dupont Formula And Equation Dupont Analysis

Dupont Analysis Roe Formula Breakdown And Calculator Excel Template

Understanding Return On Assets Roa In Real Estate Leverage Com

Roi Vs Roe All You Need To Know

Beginners Guide To Returns Roe Roa Roi R Doctorstock

Return On Assets Roa Formula Calculation And Examples

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs